9 Things People Do To Be Successful in Retirement

©Dave Ramsey

Retirement is the future for many people, but not everyone will retire successfully. Considering that the average American spends roughly 20 years in retirement, building a successful retirement fund is a habit you should implement and be proud of.

See: 6 Frugal Living Tips Retirees Should Avoid in 2024

Learn: 6 Genius Things All Wealthy People Do With Their Money

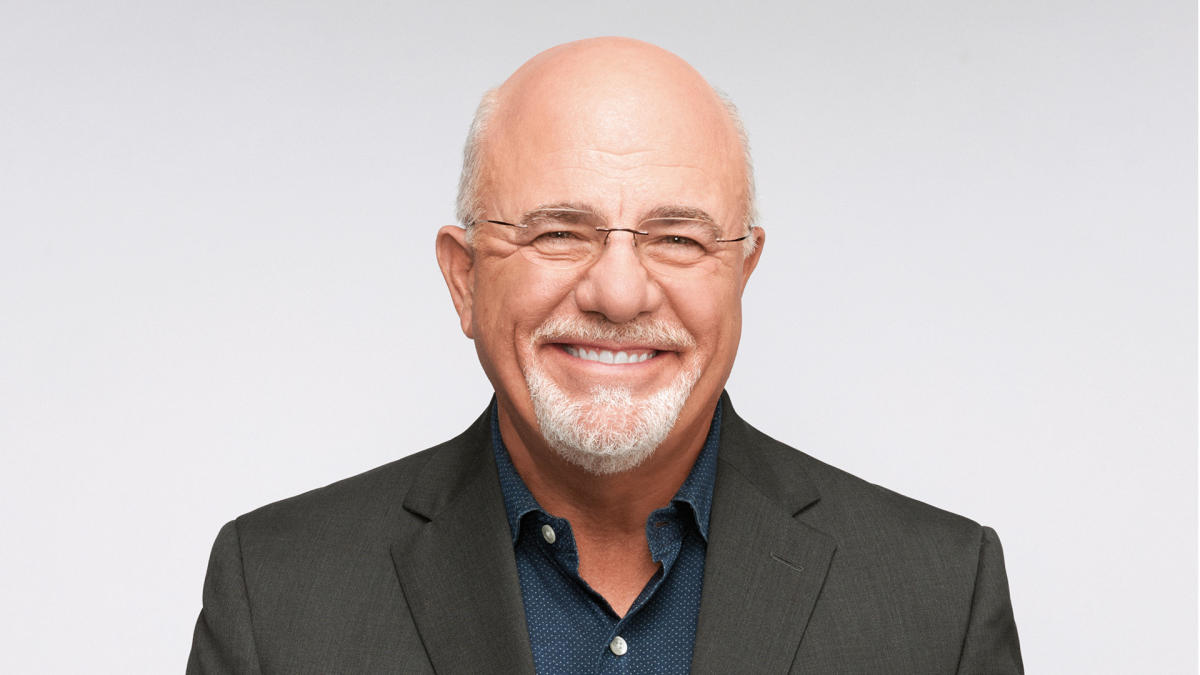

Dave Ramsey, an expert financial advisor who teaches financial management, shares nine successful things people do for retirement. Here are his tips.

Sponsored: Owe the IRS $10K or more? Schedule a FREE consultation to see if you qualify for tax relief.

Maximize Your Income To Build Wealth

Your income is the greatest tool you have to build wealth — so use it to the best capacity. This can mean no credit card use and more cash use within your income bracket. Ramsey said, “Living debt-free gives you the freedom to do more with your money.”

Stick To Your Monthly Budget

Every dollar counts. The most insignificant amounts can build up over time, and exceeding your budget can result in a loss of funds that could have been channeled into your retirement. When you stick to your budget consistently, it becomes a habit and you’re forced to only spend money you have previously budgeted for. According to Ramsey, “Small everyday choices make the difference in the long run.”

More: Retired but Want To Make Passive Income? Here Are 6 Ideas for Retirees To Boost Financial Security

Invest Part of Your Income Toward Retirement

No matter how old or young you are, putting away some percentage of your income will set you up for retirement later. Ramsey recommends allocating 15% of your income to retirement savings. He found out that many people who invest 15% of their income reach the million-dollar mark for retirement in less than 20 years.

Implement a Long-Term Vision for Investing

Earning from investing is a long game and you shouldn’t expect results right away. Give your investments time to mature and don’t hop from one investment to the other.

Story continues

Live Below Your Means

It used to be a good idea to live within your means but even better to live below it. Spend less than you make as this leaves you with more disposable income which can be used toward savings or investments for retirement.

Stay Away From Get-Rich-Quick Investments

You may have come across an email promising you huge returns on investments in the shortest time possible. Or donations to access money a nonexistent company is offering you. Don’t be tempted, as they can cause you huge financial setbacks you may not recover from. Ramsey said, “Retirement-savvy folks don’t take huge unnecessary risks with their money. They don’t bet on single stocks and don’t empty their bank accounts to invest in Dogecoin, for instance.”

Update Your Financial Plan as Needed

Always check in with your finances and make adjustments as big and small life changes come up. Life happens, and you’ll need to change your plans in accordance. For example, if you have a baby you may not be able to save 20% of your income — instead, save 10% until you start earning higher.

Work Together With Your Partner

They say two is better than one and in this case, it is true. Achieving your financial goals for a successful retirement works best with a partner who will not only keep you accountable but also contribute so you can reach your goal faster. With an extra source of income from your partner, you can reach your goals for retirement savings faster. However, be sure to do this with a financially savvy partner.

Ramsey also advises finding an accountability partner or family member if you’re single. “You can’t do this alone, you need someone cheering you in your corner.”

Always Meet With a Financial Planner or an Investment Professional

This is to ensure your financial targets are attainable. You can also get personalized advice and strategies to win that are tailored to your goals and desires. Also, consult with a financial advisor before you make big investment decisions, as your financial well-being is in their best interest.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Dave Ramsey: 9 Things People Do To Be Successful in Retirement