The CPI Report May Deliver A Massive Surprise To The Market

OlgaMiltsova/iStock via Getty Images

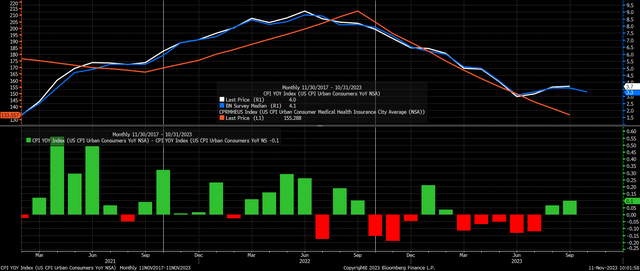

If there were ever a month where CPI could surprise to the upside, the October 2023 CPI report on the morning of November 14 would be it. Of course, the October CPI report in 2022 shocked Wall Street and sent the S&P 500 soaring by 5.5% after inflation missed the consensus estimate by 0.2% on the m/m for headline and core while missing year-over-year estimates by 0.2% on the y/y for both headline and core.

Bloomberg

Last year’s CPI report wasn’t the first time the October CPI report was a shocker. The October 2021 CPI report was an even bigger stunner when headline CPI beat estimates by 0.3% m/m and by 0.2% on core CPI m/m. Meanwhile, headline and core CPI y/y beat estimates by 0.3%.

Bloomberg

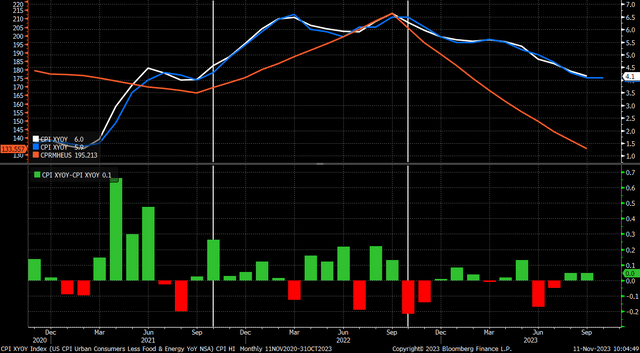

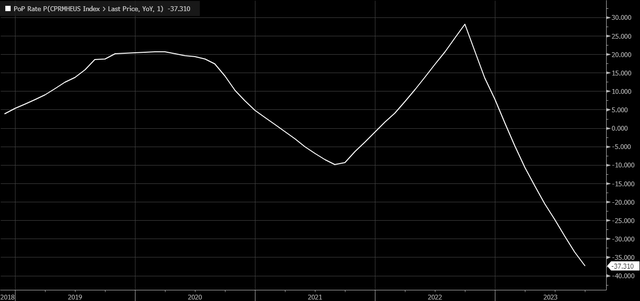

October has been an inflation stunner the past two years due to the changes in how the BLS calculates the health insurance index, which has seen some wild swings due to the rather odd method the BLS uses to calculate health insurance costs with retained earnings. According to the BLS, health insurance rose 29% from October 2021 to October 2022 and plunged 37% from October 2022 until September 2023.

Bloomberg

This equated to the health insurance index of CPI rising by almost 2% m/m in 2022 and falling by around 3.5% to 4% per month in 2023. Some analysts estimate that health insurance will rise by around 1% per month over the next year. That is nearly a 5 percentage point swing and will mean that health insurance, which has been helping to reduce overall inflation, will now be additive to inflation over the next year.

It almost appears from the data that the trend in the health insurance index coincides with the trend witnessed in the year-over-year changes in both headline and core CPI. Both headline and core CPI saw inflation rates accelerate following the October 2021 CPI report, while inflation peaked in 2022 when health insurance began to fall.

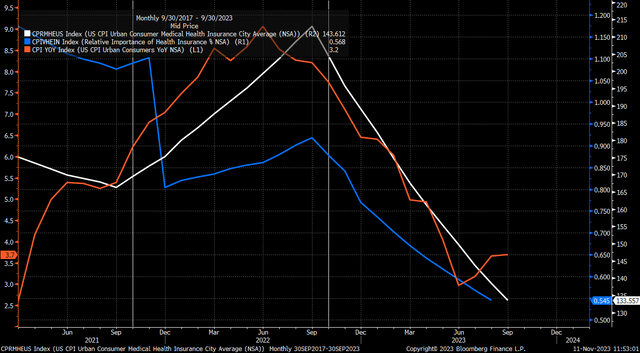

Perhaps that is because as the value of the CPI health insurance index rises and falls, the importance of insurance increases and decreases within the CPI index. The models show that health insurance rose in importance in 2022 and decreased in 2023 as the value fell. If that trend continues, the importance of health insurance may begin to trend higher in 2024, and perhaps the overall inflation trend.

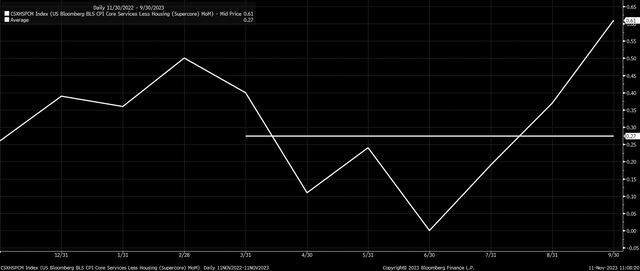

Bloomberg

Additionally, this change in health insurance will increase inflation in the overall medical care services, which Bloomberg Economics projects will rise by 0.5% in October from 0.3% in September. Most importantly, because of the weighting of medical care services in CPI core services ex-housing, Goldman Sachs noted that core services could average a 0.46% increase over the next six months. That would be almost double the average of the past six months of about 0.27%.

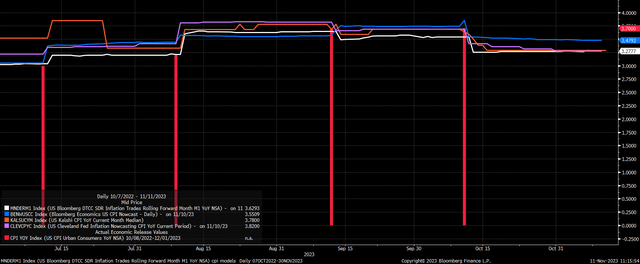

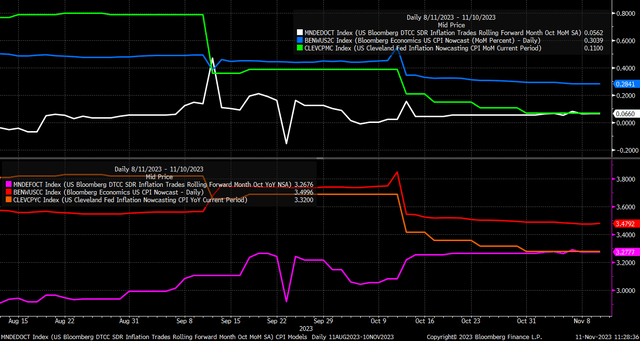

Bloomberg

That is, of course, if the adjustment comes in as expected. We won’t know the full impacts until after the data is released on Tuesday morning. The question is if the market and analysts’ estimates have correctly adjusted for these changes. There are clear signs from industry reports that profits for health insurance companies have increased in 2022 and the first part of 2023. The National Association of Insurance Commissioners report shows that net earnings for the industry rose by 29% in 2022 and an additional 6% through the first half of 2023, coming off a 41% decline in 2021.

This is probably why the October CPI the past two has been difficult for analysts and models to predict and why the results have been so vast.

At least, based on current estimates, headline CPI is expected to rise by 0.1% m/m, down from 0.4% in September, while rising by 3.3% y/y, down from 3.7% last month. Core CPI is expected to increase by 0.3% m/m and 4.1% y/y, both unchanged from last month.

The economic models don’t see things much differently, with the Cleveland Fed projecting CPI rising 3.28% y/y, Kalshi forecasting 3.29%, and Bloomberg Economics predicting 3.47%. Meanwhile, CPI swaps see headline CPI increasing by 3.27%, along with the other models. So, the consensus appears to be focused on a CPI of around 3.3% y/y when the data comes in this week, at least on the headline. The headline CPI data has come in around expectations for the past few months.

Bloomberg

The CPI estimates have come down over the last few weeks as the price of oil and gasoline have trended lower. But much of the energy effects appear to be accounted for in estimates that trended lower more recently. So the drop in energy prices should come as a shock to anyone this month.

Bloomberg

The big question mark for this month’s inflation will be where medical costs go in 2023, and much of that is likely to be determined by how the health insurance part factors into the equation. The data and forecasts seem to indicate that healthcare costs will be rising starting with this October report, and if that is the case, the case for inflation sticking around for some time only seems to strengthen.

If there was ever a time when inflation data could surprise to the upside, this October seems like the ideal candidate.