Tanker Market Could Shift Again

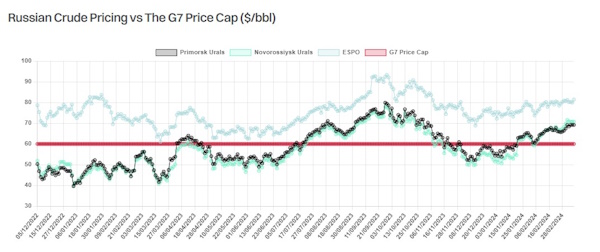

The tanker market could be set for another shift, if Russia’s oil exports force buyers in China and India to look elsewhere. In its latest weekly report, shipbroker Gibson said that “with OPEC+ set to roll over existing production cuts into Q2, the case of Russia is increasingly more complex. On top of a tightening sanctions regime, Russia is expected to make additional cuts of 471kbd on top of existing cuts of 500kbd, while current output levels stand at 9.5mbd for February according to government officials. These cuts are expected to include both crude and products and should help to keep Russian oil pricing firmly above the G7 price cap, particularly given higher benchmark brent prices. This comes as the Russian market is becoming increasingly more difficult for many players to get involved with; as sanctions enforcement increases, things could become even trickier going forward”.

Source: Gibson Shipbrokers

According to Gibson, “recent months have seen increasing attacks against Russian oil infrastructure by Ukrainian drone forces. This has resulted in some high-profile facility shutdowns and disruptions to exports, most notably the Ust Luga and Tuapse plants, although Ust Luga is reportedly back online. The attacks on Russian energy infrastructure may continue as the war enters a new phase beyond the immediate area of conflict. Attacks on Russian refineries have also led to lower refinery runs and increased need for maintenance and repair at damaged facilities. There has also been an increase in Ukrainian naval drone operations in the Kerch strait and Crimean coast, which may pose an additional risk for vessels lifting Russian Black Sea cargoes on top of the threat of mines”.

Gibson added that “while this in theory should result in more crude for export as refining capacity remains offline, Urals prices as reported by pricing agencies remain above the $60/bbl price cap, limiting opportunities. On top of this, exporting Russian crude has become more challenging as more tankers and operators face sanctions and western owners increasingly pull back from engaging in this trade. Although overall crude export levels have remained steady since the start of the year, averaging 3.48mbd with the bulk of which heading to India and China, we have likely seen these flows peak. The recent case of undelivered Sokol grade crude due to sanctions and payment issues has likely also made some buyers hesitant to increase their intake of Russian grades. The expectations of even further sanctions and compliance requirements going forward will add only further incentive to pull back from Russian linked oil trades”, the shipbroker noted.

“What is this likely to mean for the mainstream tanker market? Firstly, if lower Russian export volumes materialise, buyers in India and China will be forced to seek replacement barrels from the Middle East and the Atlantic, which may lend support to the VLCC sector. However, the biggest impact is likely to be seen in the Suezmax and Aframax sectors, where a significant number of vessels, capable of trading Russian barrels and in the conventional trade, could migrate back into the mainstream market. This will also coincide with the easing of seasonal Turkish Straits delays, multiplying the downward pressure. Overall, tighter enforcement of price cap threatens to shake up the business model established since 2022, with the brunt of the impact felt by the mainstream market”, Gibson concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide