ICE Aims to Expand US Consumer Interest Rate Markets

Jeffrey Sprecher, chair and chief executive of ICE, said the growth of its Brent suite of contracts provides a blueprint for the expansion of other businesses, including the energy complex and data services.

Jeff Sprecher, ICE

Sprecher said on the results call on 8 February that when ICE acquired the International Petroleum Exchange in London in the early 2000s, its flagship product was a small futures contract on a grade of oil called Brent, which was not well known at the time.

ICE began working with the oil industry, and drove a consensus to allow other grades of oil from locations away from the Brent oil fields to make their way into a newly reconstituted ICE index, which it continued to call Brent.

“Over time we’ve evolved the index by adding oil from other fields and it is safe to say there is no longer any Brent in the ICE Brent index,” he added. “We’re following a similar roadmap with our entire energy complex.”

Sprecher continued that ICE continued a similar theme by creating the data services division nearly nine years ago.

“We spotted the trend that the single most important asset associated with automation was trusted mission critical data and digitised information,” he said.

Data services is also transforming global benchmarks for financial products in areas such as credit and interest rates.

“Importantly, we are leaning into this blueprint to drive ICE’s most recent expansion with a goal to expand participation, facilitate information transparency, and spawn index creation in the US consumer interest rate markets,” he added .

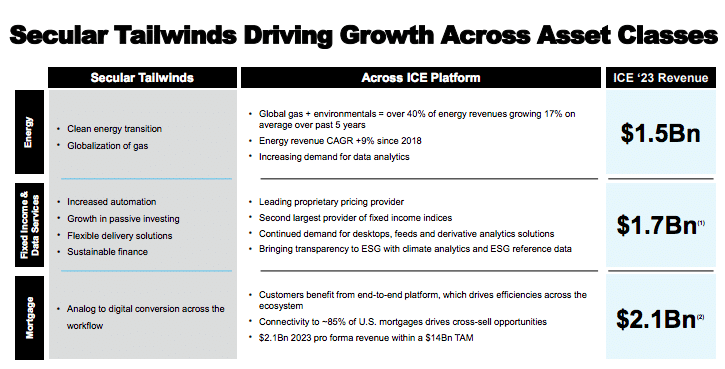

Ben Jackson, president of ICE and chair of ICE mortgage technology, said on the results call that strong 2023 results were in part driven by a dynamic macroeconomic environment, but also long-term secular tailwinds that will continue to drive growth across asset classes in a variety of market conditions.

Source: ICE

The secular tailwinds across the energy complex include the globalisation of natural gas and the clean energy transition.

“We have invested in building a global platform that positions us well to provide critical price transparency across the energy spectrum that will help enable participants to navigate the clean energy transition,” added Jackson.

In the oil market, ICE’s licenced Brent benchmark underwent its latest evolution with the addition of Midland WTI into the Brent basket. This latest evolution contributed to record Brent volumes in 2023, surpassing the record last set to 2021, demonstrating that the market depends on the benchmark’s ability to reflect global fundamentals according to Jackson.

“At the same time, our WTI contract reached record volumes and continues to gain share as trade dynamics evolve and become increasingly complex, customers are not only seeking liquidity in the major global benchmarks but also in products that provide greater hedging precision,” he added.

Ben Jackson, ICE

Jackson said ICE has adopted a similar playbook for international gas markets as it did for oil by building a global platform that spans benchmarks across North America, Europe and Asia.

“As energy supply chains evolve and globalise the quality of our expansive range of benchmarks is evident with our global gas business delivering record revenues in 2023, increasing 44% year over year,” he added.

He continued that ICE recognised the need for carbon price transparency more than a decade ago. Last year was a record year in North American environmental markets with volumes up 7% year-over-year.

“The globalisation of natural gas and the energy transition are trends that we began investing in over a decade ago,” added Jackson. “Today, cleaner energy sources including global natural gas and environmentals made up over 40% of our energy revenues and have grown 17% on average over the past five years.”

Financials

Warren Gardiner, chief financial officer of ICE, said on the results call that the group generated record revenues and record operating income, which was the eighteenth consecutive year of record revenues and earnings per share.

Full year consolidated net revenues for 2023 were $8bn, up 10% year-over-year. The total included exchange net revenues of $4.4bn, up 9% year-over-year and fixed income and data services revenues of $2.2bn, up 7% over full year 2022.

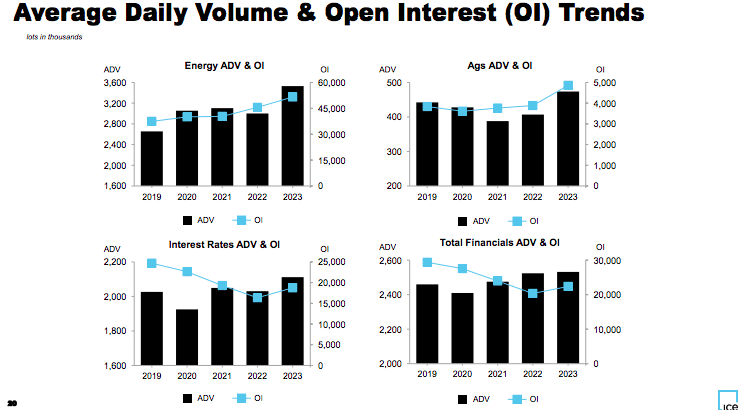

The strong performance of the exchange platform included a 41% increase in oil revenues, 66% growth in global natural gas revenues and 23% growth in the environmental business.

Source: ICE

“In addition, January sets the tone for what we expect will be another strong year, evidenced by robust levels of total open interest of 20% year-over-year, as well as record average daily volumes across commodities, energy and total options,” added Gardiner.

In May 2023 ICE increased fees on some futures contracts for the first time in many years and Gardiner said the move went “pretty well” with a positive impact on rate per contract and record volumes in 2023, which have continued into January this year.

“Our philosophy is to look across the platform and for areas where we have created value and where we can then capture value and we do that every year ,” said Gardiner. “We’ve done within the futures business, we made some adjustments to exchange data fees and we also made some adjustments on collateral fees at our clearing house.”

In 2024 ICE expects revenues in the exchange segment to grow in the low-single digits.

Revenues in the fixed income and data services segment were boosted by a 19% increase in transaction revenues and 23% growth in ICE Bonds, after a 100% increase in ICE Bonds revenues in 2022.

Warren Gardiner, ICE

Gardiner said: “ICE Bonds has grown at a compound annual growth rate of 11%, driven by growing institutional adoption and higher interest rates.”

There was also continued growth across desktop feeds and derivative analytics. Within the desktop business, there was strong demand for energy and environmental data, as well as continued robust growth in the ICE Chat offering.

Jackson said ICE is focused on continuing to expand products and services which add transparency to both commonly understood risks, as well as emerging risks. For example, fixed income data is being combined with third-party geospatial data to help market participants better manage climate risk.

ICE also completed the acquisition of mortgage technology provider Black Knight in September 2023 and Jackson argued there are a number of datasets in Black Knight that are highly applicable to capital markets, which will lead to product innovation.

“Looking to 2024 we expect that recurring revenues in our fixed income and data services business will grow in the mid-single digit range as we expect the aforementioned trends across fixed income data and analytics, desktops and feeds,” added Gardiner.

NEWSLETTER SIGN UP

And receive exclusive articles on securities markets