How to use TIPS to provide an inflation-adjusted income stream in retirement

Inflation is slowing down, hopefully for good. But real interest rates — what you can earn from investing in safe government bonds over and above inflation remain high. Since 2022 real yields on Treasury inflation-protected securities (TIPS), also known as inflation-indexed bonds, have gone from below zero to roughly 2%. Where savers were once willing to lend their money to the U.S. government in exchange for limiting their loss, they are now being compensated quite handsomely.

Figure 1. Real interest rates have risen dramatically over the past few years

Board of Governors of the Federal Reserve System

For those preparing for or already in retirement, this is especially good news. Buying individual TIPS that mature across different years — a strategy known as building a TIPS ladder – can help you lock in a stream of inflation-adjusted income for as long as 30 years.

Let’s put this into perspective. When real rates were 0% back in early 2022, it cost about $1 million to build a TIPS ladder producing $100,000 of inflation-adjusted income each year for the next 10 years. Now, with real rates near 2%, the same decade of $100,000 of annual inflation-adjusted income costs about $900,000.

Think about that for a minute. The same stream of dollars, precisely the same purchasing power, now costs $100,000 less, letting you spend $10,000 more a year.

Learn more: How to use TIPS to build up retirement wealth

Your financial plan

What does this mean for your financial plan? Now’s a good time to build your TIPS ladder. Doing so can help you lock in a higher living standard without taking unnecessary risk.

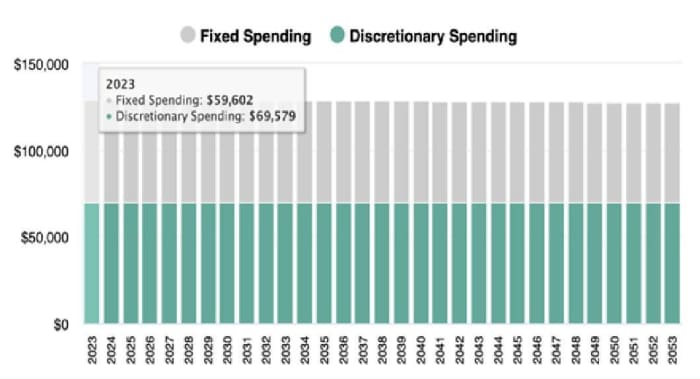

Let’s be more concrete. Consider the Johnsons, a 70-year-old retired couple with $40,000 a year in Social Security income and $2 million in savings, including $1 million in retirement accounts and $1 million in taxable investments. Back in early 2022, when real rates were 0%, if they had created a financial plan using a planning tool such as MaxiFi Planner, an application sold by a company I run when I’m not teaching, they could have built a TIPS ladder to support their spending over the next 30 years. They could safely afford to spend about $49,671 on discretionary spending, adjusted for inflation, each year through age 100. Discretionary spending is spending on top of fixed expenses, like housing, taxes and Medicare premiums.

Now, with real rates at about 2%, the Johnsons, with the exact same financial goals and resources, can safely afford to spend $69,579. In effect, the higher real return on TIPS has safely increased their discretionary spending in retirement by $19,908 every year for life. That is a 40% increase in their standard of living.

Figure 2. Higher real rates have increased how much the Johnsons can safely afford to spend on their living standard

Check out: MarketWatch’s How to Invest section

How to build a TIPS ladder

In practice, building a TIPS ladder means buying inflation-indexed Treasury bonds of different maturities, either from your regular assets or a brokerage account in your IRA. The goal is to have the TIPS provide inflation-adjusted income — a combination of interest and principal payments — in each year to meet some or all of your spending needs.

Figuring out how much real annual income you need the ladder to produce, and for how long, is probably the most important question to address first. Start by considering how to build a TIPS ladder that produces at least enough income in addition to Social Security (and any other guaranteed income you may have, like a pension or annuity) to cover all your fixed costs in retirement.

Building a ladder is relatively straightforward. Use an online application like Tips Ladder to determine the best bonds for your situation, and then buy those bonds through your discount broker. It can be done in an afternoon — although getting a real human on the phone is usually best.

Let’s consider the hypothetical Johnson family again. Between paying their taxes and covering housing and Medicare-related costs in retirement, their annual fixed spending is projected to be about $60,000, adjusted for inflation, for the next 30 years.

Figure 3. The Johnsons expect to spend about $60,000 a year on fixed expenses in retirement

With $40,000 of inflation-adjusted annual Social Security income, this means the Johnsons will require an additional $20,000 of inflation-adjusted annual income for the next 30 years to cover all of their fixed spending ($60,000 — $40,000 = $20,000). At today’s real rate of 2%, this will cost them about $450,000. (Note that when TIPS rates were 0%, the equivalent ladder cost $600,000.) If they wanted to cover some portion of their discretionary spending as well — the turquoise bars in figure 3 — they could invest even more into their TIPS ladder.

Plus: Annuities, Social Security, inheritance: How much money do I need to retire?

Upside investing basics

Let’s say you want to use TIPS to safely cover all of your fixed spending plus some minimum acceptable level of discretionary spending in retirement — what we’ll call your living-standard floor. Having locked in this living-standard floor you can now engage in so-called upside investing, by investing your remaining savings in risky assets like stocks.

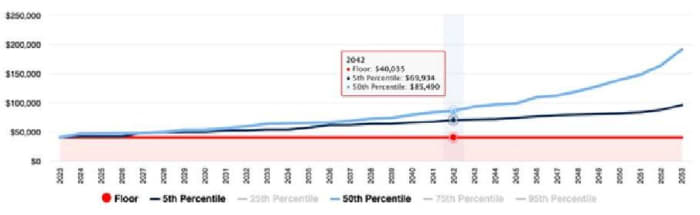

If the stocks underperform (or go to zero) you can still safely maintain your living-standard floor. And, if they perform as (or better than) expected you can safely increase your living-standard floor each year by converting a portion of the stocks to TIPS over time. Let’s consider the Johnsons again.

The Johnsons desire a discretionary spending floor of about $40,000 a year, adjusted for inflation. To accomplish this, in addition to covering all their fixed spending in retirement not already covered by Social Security, they invest about $1.35 million of their savings into a TIPS ladder that produces about $60,000 of annual real income for 30 years ($40,000 to pay for their living-standard floor and $20,000 to cover their residual fixed spending).

Then, they take their remaining $650,000 of savings and invest it in stocks, like a low-cost S&P 500 index fund. Each year they sell a portion of the stock — gradually, so they do not risk exhausting this cushion before they die.

Invest that capital gain in TIPS and you can consistently raise your living-standard floor throughout retirement. If stocks perform poorly (see dark blue line in Figure 4), the Johnsons’ living standard floor may not rise much. But, if stocks perform as expected (see light blue line), the Johnsons will be able to spend well above their floor by capturing the upside.

Figure 4. The Johnsons use TIPS to lock in a $40,000 living standard floor, and then invest the rest in stocks, hoping to increase discretionary spending in the future.

In a sense, upside investing is like having your cake and eating it too. By using TIPS to cover your fixed spending and lock-in a desired living-standard floor in retirement, you can safely invest in stocks for their potential upside. The lower you set your living standard floor, the greater is your potential upside, and vice versa.

Also read: As you near retirement, scrutinize your Social Security statement. Here’s what catches an adviser’s eye.

Summarizing the strategy

With real (inflation-adjusted) interest rates higher than they’ve been since the 2007-09 recession, you can now safely afford to spend more without having to take unnecessary risk. This strategy involves building a “TIPS ladder” — that is, a portfolio of individual Treasury inflation-protected securities that mature on different dates over the coming years.

Locking-in a stream of real income payments in retirement via a TIPS ladder can both safely cover your fixed spending and create a living standard floor. Surprisingly, this approach can also make investing in stocks less risky from a living standard perspective. By setting a comfortable living-standard floor using TIPS, you can effectively afford to take more risk with your remaining investments in hopes of increasing your living standard throughout retirement.

Jay Abolofia, a Ph.D. economist and Certified Financial Planner, is president of Lyon Financial Planning in Waltham, Massachusetts.

Laurence Kotlikoff is a co-author of “Get What’s Yours from Social Security” and a professor of economics at Boston University.

This article is reprinted by permission from NextAvenue.org, ©2024 Twin Cities Public Television, Inc. All rights reserved.

More from Next Avenue: