How I use Copilot for iPhone and Mac to live a healthier financial life

A few weeks ago, we went in-depth on the powerful Copilot budgeting app for iPhone, iPad, and Mac. I’ve been using the Copilot budgeting app to manage my entire financial system for several years, and thought it would be useful to dive deeper into how and why I use it.

Plus, 9to5Mac readers can use code 9TO5MAC and unlock an extended two-month free trial.

How Copilot helps my family create – and stick to – our budgets

My budgeting process using Copilot consists first of linking my bank accounts, investment accounts, and credit cards to the app. As we explained last month, this is all very seamless through Copilot. Once I authenticated my various accounts, all of my transaction history

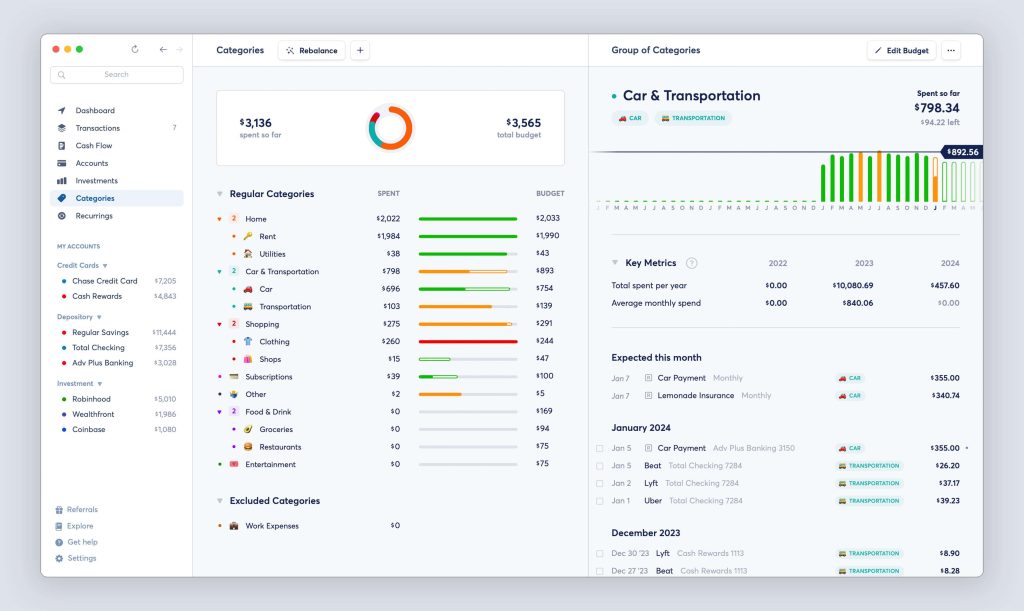

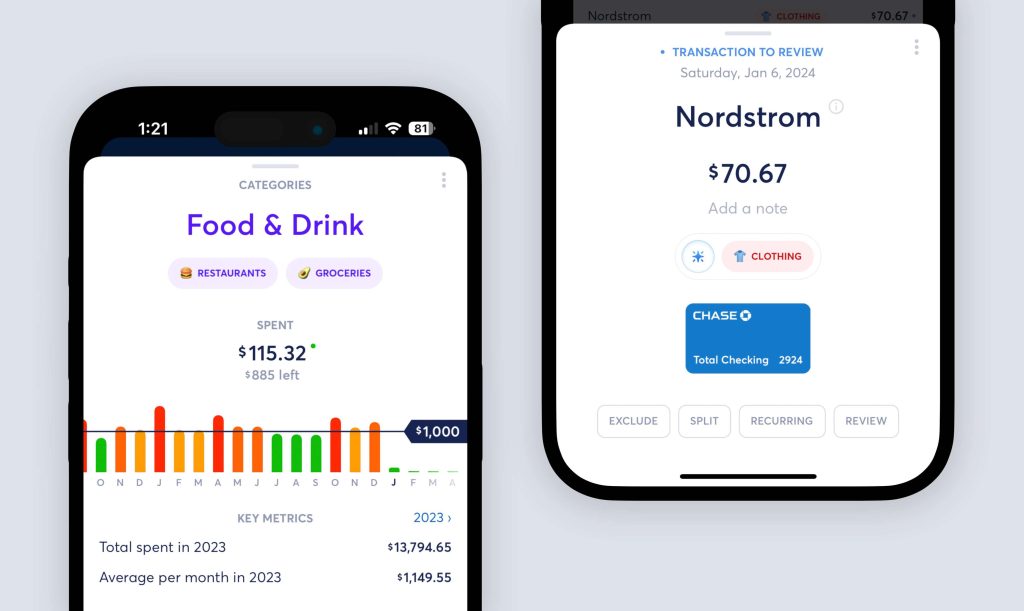

I have custom budgets setup in Copilot for different categories of transactions. This includes things like restaurants, rent, groceries, transportation, utilities, and more.

Using its advanced artificial intelligence features, Copilot is able to automatically categorize transactions. It also learns over time and becomes smarter about which transactions you’d like in specific categories. I’ve been using Copilot for long enough that it’s pretty good at correctly categorizing my transactions, but I still make a point to review new transactions in the app – and make corrections – when necessary.

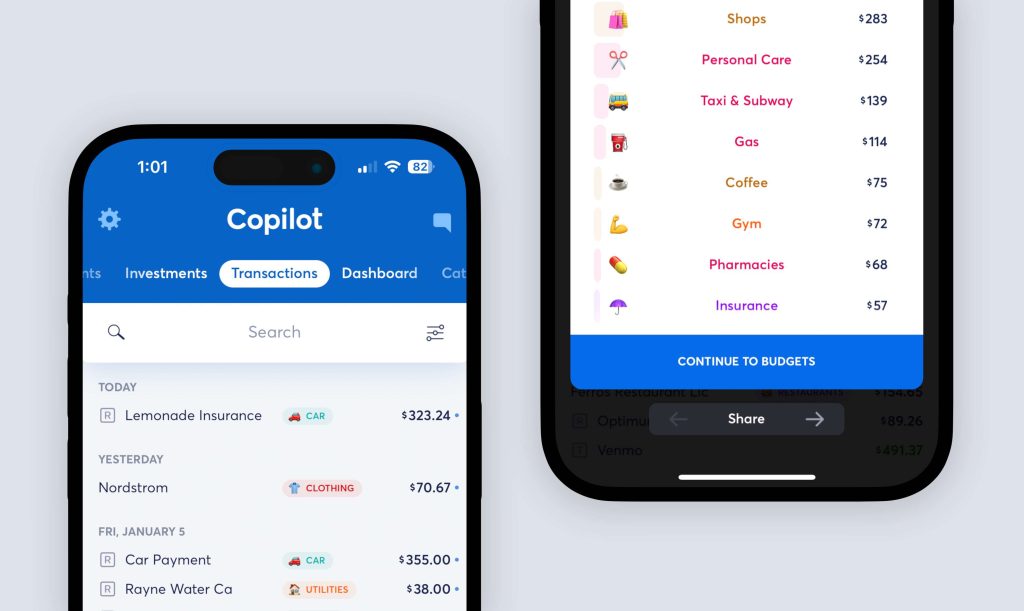

Copilot also creates budgets based on your previous spending habits, but you can also fine-tune the specific amounts for each category. For example, when I set up Copilot for the first time and imported my transactions, I was pretty amazed (appalled?) at how much I was spending at restaurants (or DoorDash) every month. I quickly lowered that goal and have made it a priority to stick to that budget.

This is just one of the many ways Copilot has helped me get a clearer picture of my finances. It’s very, very easy to casually spend money – especially through food delivery apps – without realizing just how much you’re spending. It starts to add up quickly, trust me!

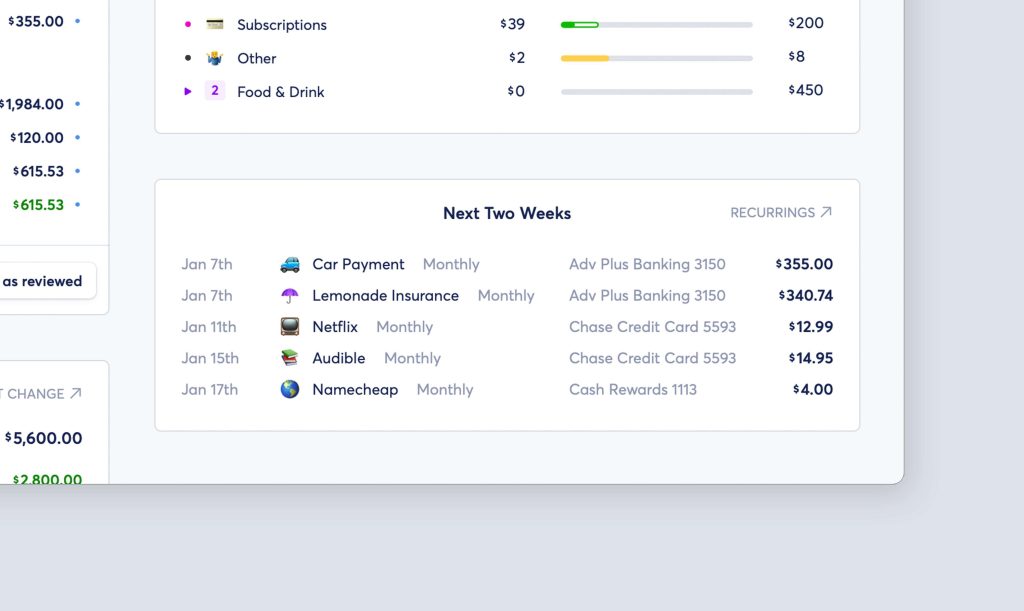

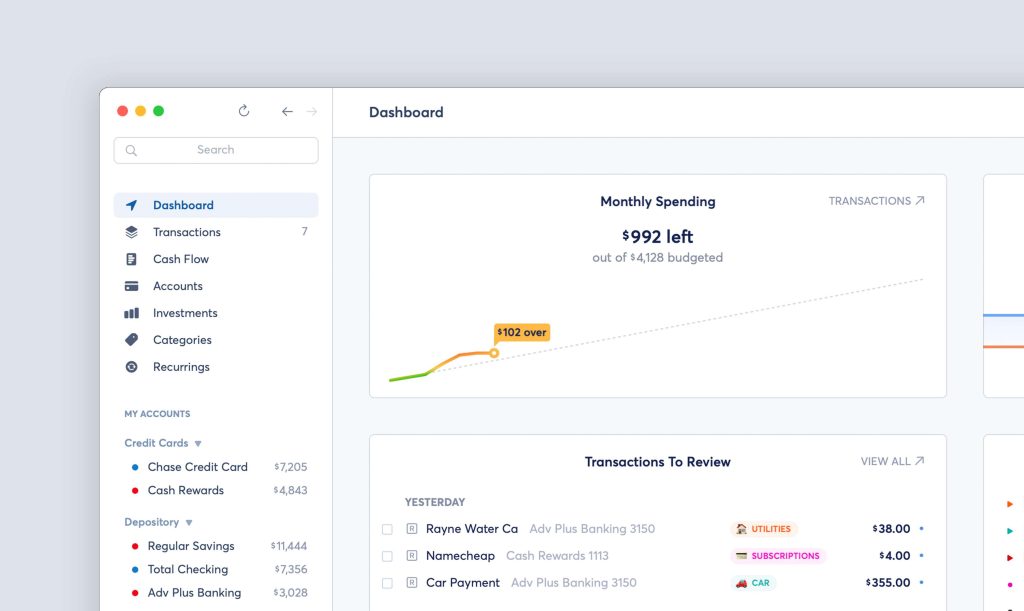

Another one of my favorite Copilot features is the “Upcoming” section of the “Dashboard” screen. Here, Copilot shows me upcoming expected recurring charges. In addition to this being helpful information to know about from a financial planning perspective, it also serves as a great way to remember to cancel subscriptions before they renew every month.

“Oh, my YouTube TV subscription is set to renew next week, but MLB playoffs are over. I need to go cancel that,” I thought to myself – thanks to Copilot – a few months back.

Also on the “Dashboard” screen, there’s a very helpful graph that shows me my spending progress throughout the month. This makes it really easy to get a quick glimpse at how my current spending rate compares to my overall budget. If I don’t have the time or energy to dive into the specifics of my budget on a given day, I can quickly open Copilot, glance at the spending graph, and know whether I’m on the right track.

You’ve probably realized by now that the “Dashboard” tab of the Copilot app is where I spend most of my time. And you’d be right about that! But it has plenty of other things to offer. The “Categories” tab shows me more in-depth data on each budget category, as well as another helpful look at what I’ve spent so far compared to my total budget.

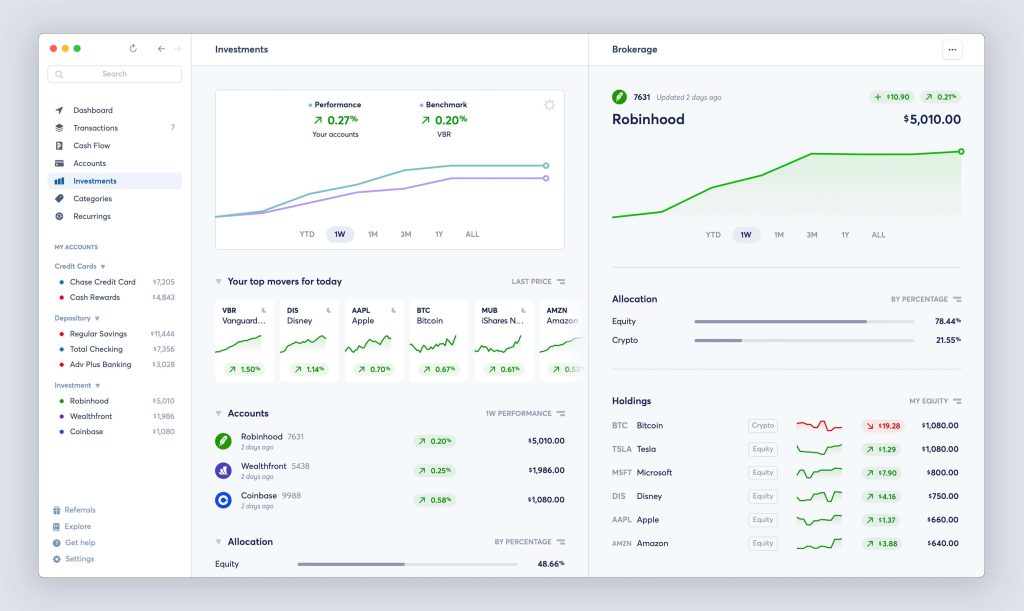

The “Recurrings” tab gives me a more long-term look at recurring transactions and estimated withdrawal dates. I’m not big into investing, but if you are, Copilot has you covered there with an ultra-powerful “Investments” dashboard.

The “Transactions” tab shows me more transaction history for all of my accounts – including the ability to search and filter this information. I also enjoy seeing the “Month in Review” data each month, showing our total income, total spent, and whether we came in over or under budget.

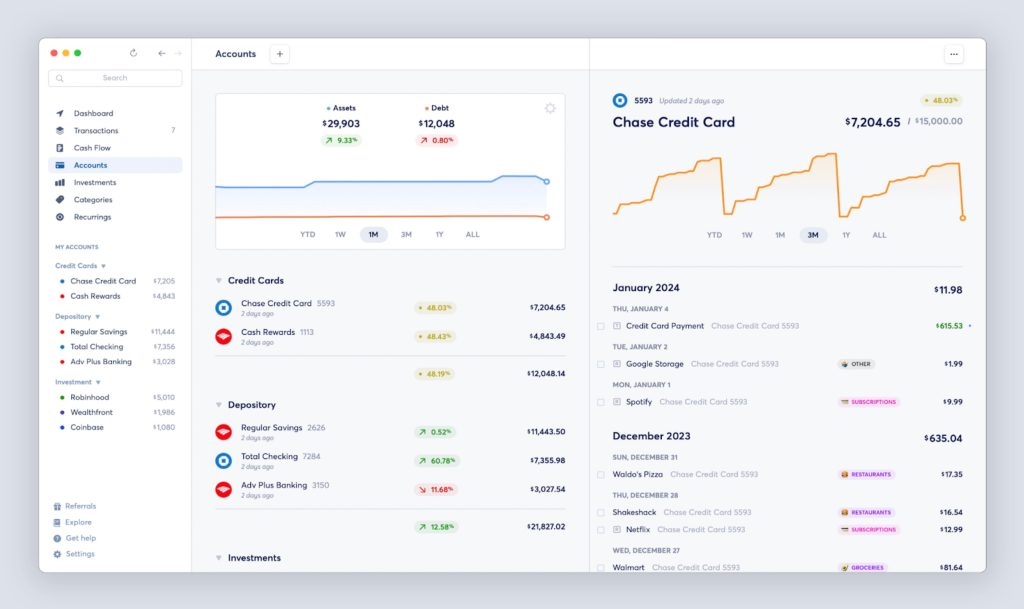

Finally, there’s an “Accounts” tab in Copilot…and this is probably my second most-used screen in the app. Here, I can see a detailed breakdown of each of my credit cards and accounts. This includes everything from car loans to real estate to savings and much more.

I find it very helpful to have a one-stop-shop where I can see all of this information at a glance. Copilot also distills it down into a chart that shows you your assets compared to your debts over the past year, week, month, three months, and the current year-to-date. For credit cards, it even shows my current utilization rates. And for depository accounts, I can see the percentage change over those same time periods.

Wrap up

For me and my wife, Copilot ticks all the boxes for what we need and want in a budgeting app. Prior to discovering Copilot, I’d really struggled to find a budgeting app that worked for my lifestyle and career. My income in particular can vary on a month-to-month basis, given the life of online publishing and advertising.

Copilot is flexible enough to help me accommodate these changes in income, while also being rigid enough to ensure we stick to our budgets each and every month.

Another thing I really enjoy about Copilot is how it can show you not only your current financial state but also projections into the future and a look back at the progress you’ve made. What’s more encouraging than seeing that separation between your assets and your debts continue to get wider and wider?

9to5Mac readers can use code 9TO5MAC and unlock an extended two-month free trial of Copilot. The app is available on iPhone and Mac, and a universal subscription unlocks both platforms.

Written by Chance Miller

FTC: We use income earning auto affiliate links. More.