Whale watch: $1B in Toncoin trades shake the market, tracking what’s next

- Toncoin has seen a surge in whale activity on its network.

- TON, however, is at risk of a price decline.

Toncoin [TON] has witnessed a spike in whale activity on its network in the past few weeks, CryptoQuant analyst Joao Wedson found in a new report.

According to Wedson, whale transactions between 100,000 and 1 million TON on the network recently surpassed $1 billion,

“Indicating significant activity among the largest addresses on the network.”

Wedson added that while the smaller transactions under 100 TON make up the vast majority of the total activity on the Toncoin network, although,

“Their impact is relatively low, moving only around 4 to 5 million TON on the blockchain.”

In contrast, large transactions between 100,000 and 1 million TON account for more than half (53%) of the network’s total volume.

Further, transactions exceeding 1 million TON currently represent 30% of Toncoin’s total volume.

TON whales fail to move the needle

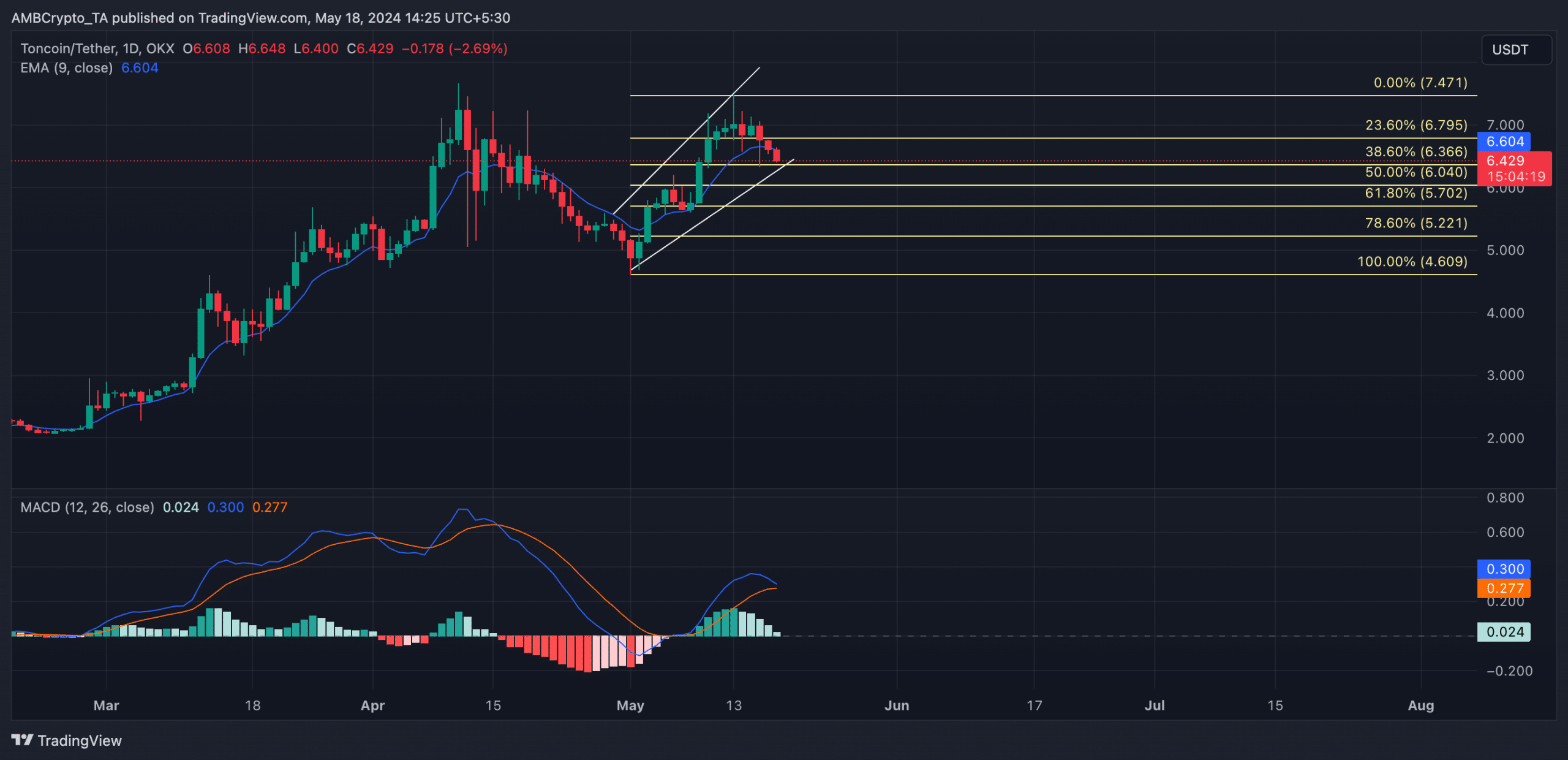

Despite the surge in whale activity on its network, TON is poised to breach the lower line of its ascending channel, which formed a key support level since the beginning of the month.

When an asset’s price trends this way, it signals that selling pressure is overcoming buying pressure, and a price decline might be imminent.

TON’s recent fall below its 20-day Exponential Moving Average (EMA) increases the likelihood of its price decline.

Readings from the coin’s price movements on a daily chart showed that TON’s price crossed below its 20-day EMA on the 17th of May. This marked the first time this has happened since the month began.

This crossover is significant because it suggests that TON’s press time price has fallen under its average price of the past 20 days. It marks a shift toward selling momentum and a possible decline in the coin’s price.

Since then, TON’s value has dropped by 3%. According to CoinMarketCap, the altcoin traded at $6.45 at press time.

Confirming the rise in bearish sentiments, TON’s MACD line was about to fall below its signal line at the time of writing.

Source: TON/USDT on TradingView

Is your portfolio green? Check out the TON Profit Calculator

When this happens, it would mean that the coin’s short-term moving average has crossed below its long-term moving average, signifying a loss of upward momentum.

If TON breaches support, its price might fall under $6 to trade at $5.70. However, if this is invalidated, a rally toward $6.7 is in the books.

Next: Predicting how ETH will react IF the SEC approves Ethereum ETFs