‘Shocking’ mortgages could see 1million Brits trapped in deals past retirement age

Around one million young Britons are “gambling their retirement” prospects by taking on mortgages due to run past the state pension age, a former pensions minister has warned.

Sir Steve Webb, a partner at LCP (Lane Clark & Peacock) and former Liberal Democrat MP who served under the Coalition Government, is warning of the “shocking” number of deals which run past the retirement benefit’s age threshold.

A Freedom of information (FOI) data supplied by the Bank of England found 42 per cent of new mortgages in the last quarter quarter of 2023 had terms going past the state pension age.

In the same period, 38 per cent of new deals had terms ending beyond 66 with 32 per cent of new terms exceeding past this threshold in Q4 of 2021. According to Sir Webb, one million new mortgages have been issued with end dates past the state pension age over the last three years, based on these figures.

He said: “The challenge of getting on the housing ladder is forcing large numbers of young home buyers to gamble with their retirement prospects by taking on ultra-long mortgages.

“We already know that millions of people are not saving enough for their retirement and if some of that limited retirement saving has to be used to clear a mortgage balance at retirement they will be at even greater risk of poverty in old age.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

A former pensions minister is warning young people of “shocking” mortgage deals

GETTY

In the fourth quarter of 2023, homebuyers aged 30 to 39 made up 30,943 new mortgages lasting beyond state pension age and people aged 40 to 40 accounted for 32,305.

Younger borrowers aged under 30 came to 3,676 of these mortgages, people aged 50 to 59 accounting for 18,854, 60 to 69-year-olds taking out 4,955 and people aged 70-plus making up 661 deals.

Sir Steve noted that many Britons may be unable to service a mortgage once they finally retire and will raid their pension savings to clear their mortgage which will result in them having less money in old age.

According to the retirement expert, even if mortgage deals run up to pension age, it stops Britons approaching retirement of enjoying a period of time where they are mortgage-free and able to boost their pension savings.

Last autumn, the Bank of England’s Financial Policy Committee (FPC) revealed that since the first quarter of 2021, the proportion of new mortgage lending with a term of 35 years or more has risen by eight percentage points.

As of the second quarter of 2023, these mortgages made up 12 per cent of new deals with the FCP noting they could increase debt burdens on homeowners over the long term.

According to financial information website Moneyfacts, the average two-year fixed homeowner mortgage rate on Friday was 5.94 per cent, up from 5.93 per cent on Thursday.

Savills, the property firm, recently shared that property values across the UK are expected to go up by 21.6 per cent on average by the end of 2028.

Karina Hutchins, UK Finance’s principal for mortgage policy, said: “The proportion of longer-term mortgages has been increasing in recent years as buyers to look for ways to stretch their affordability.

“When reviewing new mortgage applications, lenders will act within the responsible lending rules set by the Financial Conduct Authority and carefully consider whether the borrower will be able to afford their mortgage in the future.

LATEST DEVELOPMENTS:

“This will include whether the requested term would take the borrower beyond their anticipated retirement age. Where this is the case, it is common practice for lenders to request proof of pension. Those closer to retirement, usually within 10 years, may need to satisfy their lender that they can afford the mortgage based on their retirement income.

“Whilst longer mortgage terms can offer lower initial monthly repayments, the borrower will pay more in interest and have less disposable income to put into their pension if the mortgage runs for its full term. We would encourage customers to speak to an independent mortgage adviser to discuss the best options available for their specific circumstances.”

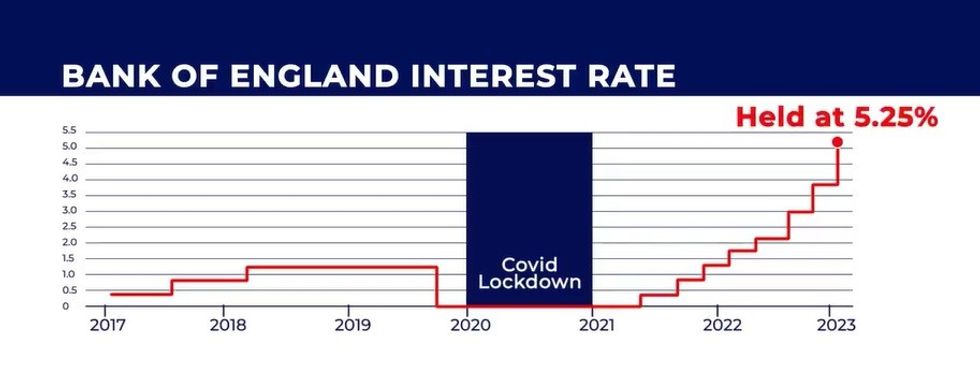

Prospective homebuyers have been saddled with historic high mortgage rates due to the Bank of England’s decision to raise the base rate to 5.25 per cent in the central bank’s fight against inflation.

At the same time, experts are urging policymakers to overhaul the UK’s pensions system due to working-age people facing a worse-off retirement than their parents and grandparents.